Part A (hospital coverage).

Medicare Part A is the portion of Medicare that pays hospital costs. Part A also includes some benefits for skilled home care, hospice care, and the first 100 days of skilled nursing care. You probably won’t have to pay any premiums for Part A, because you already paid for it with payroll taxes while you were working.

In 2022, you have to pay the first $1,556 of the cost of each hospital stay. Part A covers the rest for the first 60 days, and then you pay the first $389 per day for days 61–90. After that, there are “lifetime reserve” days (you have a total of 60 days to use in your lifetime, and then they are done), for which you pay the first $778 per day. You are responsible for the full cost of any additional days.

B (medical coverage).

Medicare Part B is the portion of Medicare that covers outpatient health care visits such as doctors, outpatient surgery, diagnostic testing, durable medical equipment, and ambulance services. Part B is not free. You’ll pay premiums ($170.10 per month in 2022)—and if your income is over a certain amount, your premiums are subject to surcharges.1

Under Part B, you are responsible for the first $233 of covered medical services. Once that deductible is met each year, you will typically owe 20% of the cost of such services, although you may also owe “excess charges” for some providers.2

Part C (Medicare Advantage).

Part C plans are private plans that contract with Medicare to provide Medicare A and B benefits. Many of these bundled plans are available for only the cost of the standard Part B premium. About 60% of Medicare Advantage enrollees are in HMO plans, with the vast majority of the rest in PPO plans (The Henry J. Kaiser Family Foundation, 2021).

Part D (prescription drug coverage).

Part D plans are optional prescription drug plans available to everyone who has Medicare. These private plans contract with Medicare to provide at least a standard level of prescription coverage. They are available both as stand-alone plans and as part of Part C (Medicare Advantage) plans. Premiums vary, and there are surcharges for those with higher incomes, but as of 2022, they will range from $12.40 to $77.90 per month.

Medicare supplemental insurance (Medigap).

Medigap policies are private policies designed to cover expenses not covered under Part A or Part B. They follow standardized forms, designated with letters A through N. Medigap policies add to the “alphabet soup” confusion—Medicare Part A and Medigap Plan A are not the same thing! Any Medigap policy designated with a particular letter provides a specific set of benefits, regardless of which company issues it.3

Important Medicare dates

NEW ENROLLEES—SIGN UP FOR MEDICARE BEFORE YOU TURN 65

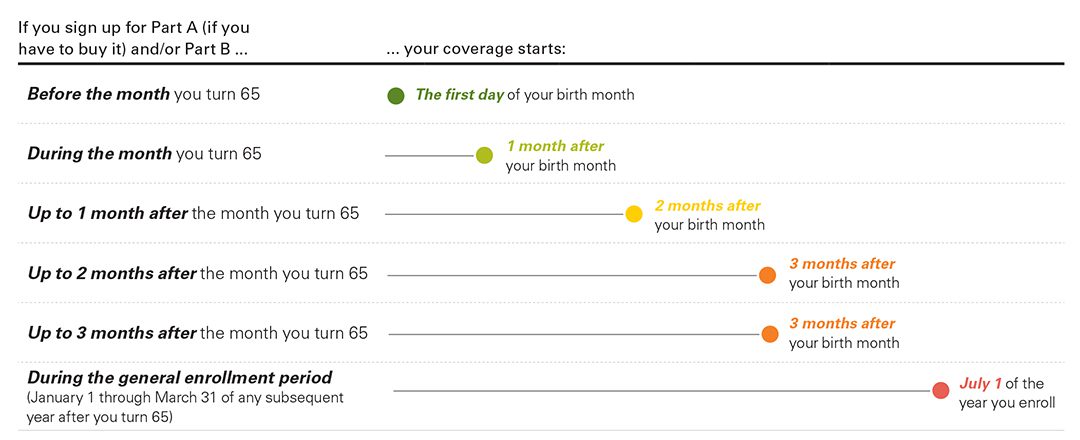

Regardless of which Medicare option you choose, you’ll need to make your choice in a timely manner. Otherwise, you could encounter periods of time when you don’t have coverage, and you may face premium penalties that can last for your entire lifetime (deferments apply for those with employer-provided coverage). Medicare eligibility begins at age 65, but in order to begin receiving benefits then, you’ll need to enroll before you actually turn 65.

Source: www.medicare.gov

Current enrollees—revisit your choices every year

Each year, from October 15 through December 7, Medicare has an open enrollment period for current enrollees. Use this time to review your coverage and whether it still suits your needs and priorities. It’s particularly important to look at your prescription drug coverage. Do you still have the best choices for prescription coverage given the drugs you take? Insurance carriers can and do change their formularies, preferred provider pharmacies, and prices each year.

Do note that if you want to make a switch that involves new Medigap coverage, you may have to go through underwriting to purchase the Medigap policy. This means insurance providers may be able to charge higher premiums or deny you coverage entirely. To avoid gaps, it’s a good idea to apply for a Medigap policy before your current coverage has ended.