Wealth planning designed for your financial goals.

We strive to help you secure the resources you need to plan for the future you envision.

More than 75% don’t save enough or invest skillfully enough to meet modest long-term retirement goals.

70% of wealthy families lose their wealth by the second generation…

…and a stunning 90% by the third generation, according to the Williams Group Wealth Consultancy.

Those in the highest tax bracket pay 37% of their annual income in taxes.

When faced with uncertainty, it’s best to start with a clear plan that can be adjusted as conditions evolve. No matter what’s happening in the economy and financial markets, we’re always on the lookout for ways to bring you closer to your goals.

Families, businesses, and communities have put their trust in our team of experienced advisors for decades. Now, you can turn to us for guidance as well.

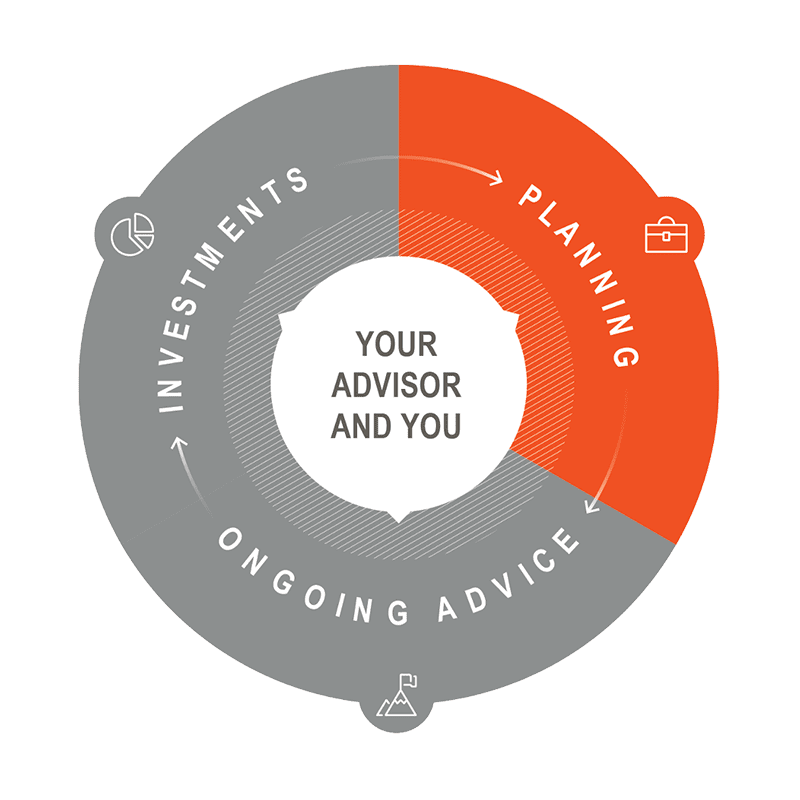

With deep planning expertise, our team will work with you to identify financial needs and goals and provide you with information to make the best decisions across a wide range of disciplines:

As you encounter twists and turns over time, we strive to guide you and help keep your financial plan on track. We adhere to our fiduciary oath, ensuring you receive the highest standard of ethics, honesty, and transparency. Deeply committed to this role, we aim to maintain the integrity of your accounts. For example, neither the bank nor the team are paid from products included in client portfolios.

Our approach starts with our people—and our client-centric attitude. We’ll work side by side with you to align your goals and investments from a risk perspective and identify planning opportunities to help you achieve your goals. Your dedicated Byline team includes:

Not every financial advisor you meet has a fiduciary responsibility, but you can rest assured knowing that our team certainly does. With decades of experience under their belts, our team members always adhere to the core principles of integrity and honesty in our client interactions. In fact, it’s required in order for us to display the certified financial planner professional (CFP®) title. Our financial planning team is available by phone, email, or in-person to help make sure you are well-positioned to achieve your financial goals.