Professional expertise for an essential service.

Protect your wealth by creating a well-designed estate plan.

A properly structured estate plan assures your assets will be available for your care during an event of disability and provides direction as to how your property is to be distributed upon your death or permanent disability. The trustee who supervises these tasks must be competent, trustworthy, and discreet.

We are devoted to maintaining a long-term relationship with you, your family, and all the professionals within your trusted circle of advisors. At all times, we are committed to remaining impartial, to serving your family in a professional manner, and to respecting your privacy.

A trust identifies how your property (i.e., stocks, bonds, real estate, or cash) will be distributed and the trustee that will be responsible for administering your trust. Trusts also provide guidance and protection for you and your beneficiaries when unexpected financial needs arise.

Our trust experts will relieve you or your beneficiaries of the day-to-day management and administration of your assets. This creates a smooth and efficient wealth transfer process that is professionally managed by a neutral third party to minimize error and conflict.

A trust may also create substantial tax savings. Assets placed in a properly drafted trust may help mitigate taxation for your spouse, children, and future generations.*

Generate good will while benefitting from the tax advantages that come with charitable trusts, such as reducing your taxable income. Charitable trusts can either be set up during your lifetime or as part of a testamentary trust. Our trust advisors can walk you through your options.

A foundation is a legal entity with a constitution and board of directors. The foundation is controlled by the board. If you want to establish a charitable foundation in your family’s name, our wealth management team can help you get started and deliver a solution.

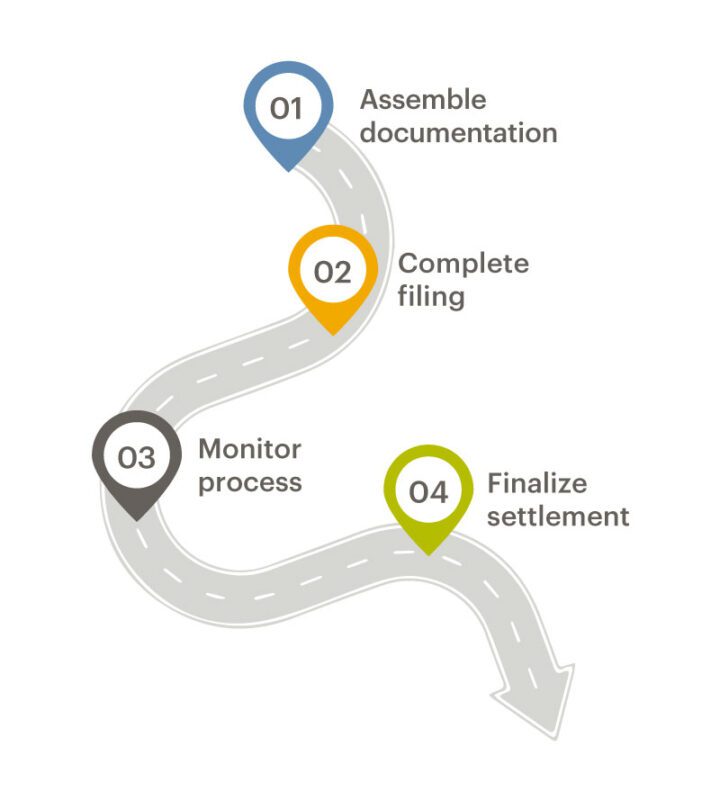

Your trust officer leads the way by facilitating all administrative duties, handling trust disbursements, and coordinating the efforts of the team. On your behalf, the Byline Bank team handles a wide range of responsibilities:

You will need to select certain fiduciaries to act in your best interest and administer your affairs, including an executor of your will, a successor trustee of your trust, and agents under your powers of attorney for property and health care.

Close relationships are the driving force behind everything we do at Byline Bank–especially when it comes to our wealth services.