Personalized investment portfolios tailored to your needs.

Every chapter of your financial journey matters. We work hard to optimize your balance of investments, refresh your risk preferences, and manage your liquidity needs along the way.

Our investment philosophy is built on a foundation of proven principles of financial management—an approach that we believe generates better outcomes over time.

We’re here to minimize financial concerns and provide recommendations to preserve and grow wealth while providing improved outcomes and lasting peace of mind. Your portfolio will be built on best-in-class products, fulfilling your investment strategies without preference for proprietary solutions.

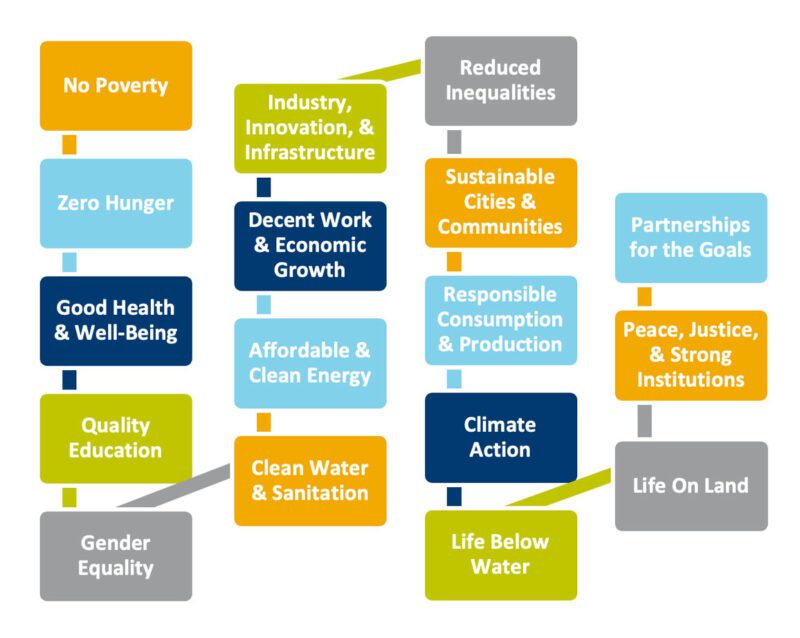

We offer mission-driven investment solutions that consider environmental, social, and governance (ESG) factors in investment selection. Focused on producing long-term sustainable value for our clients, we screen companies to assess their impact on communities and the world, while also providing a diversified, sector neutral, high-quality investment framework.

Close relationships are the driving force behind everything we do at Byline Bank—-especially when it comes to our wealth services.