If your retirement planning includes funding a traditional IRA (or 401[k]), congratulations. You’re reducing your bill to Uncle Sam in every year you contribute. Great! Right?

Maybe not so great. The flip side of traditional IRAs is that a withdrawal is a taxable event. Whether you think tax rates will be lower or higher when you’re retired, the Roth IRA may make sense for you. Until we sit down to discuss it together, here are the basics:

Pay taxes now or later?

If you have an unshakable conviction that your tax bill will be lower in retirement, your decision is easier—in favor of the traditional IRA—but it’s still no layup. First, you could be wrong. Even if you’re right, your tax savings may not outweigh the other advantages of the Roth (see below).

Let it grow: No withdrawals required, ever

Both traditional and Roth IRAs allow your savings to grow tax-free, and the earnings on those earnings, over time, are the engine of your account’s potential growth. But a traditional IRA has strict rules and stiff penalties concerning when you must begin taking withdrawals during your lifetime. On the other hand, Roth savings can continue growing tax-free over your lifetime. Both traditional and Roth IRAs allow you to continue to contribute after retirement, if you have earned income.

Lighten the tax burden on your heirs

The non-spouse beneficiaries who inherit your Roth IRA may have to take RMDs, with some exceptions, but not for 10 years, and they won’t have to pay any federal income tax on their withdrawals as long as the account’s been open for at least five years. That allows Roth owners to pass potentially significant assets to their heirs essentially tax-free.

Contribute some—Convert a lot

If you decide a Roth IRA is right for you, you can contribute up to the maximum each year, and you can also convert all or part of your traditional IRA to a Roth account, regardless of your income, with no annual limit.

The rub:

You’ll pay tax on the conversion amount in the year you make it. Generally, the further you are from retirement, the more likely you are to recoup the value of the tax paid at conversion. But the calculation can be complex. We can help you work out a break-even point.

Gain flexibility for the unforeseen

Roth IRAs allow withdrawals of contributions at any time without penalty. However, because the withdrawals of earnings before age 59½ are treated as taxable income, you may wind up with a tax emergency on top of the initial crisis. Explore other options first.

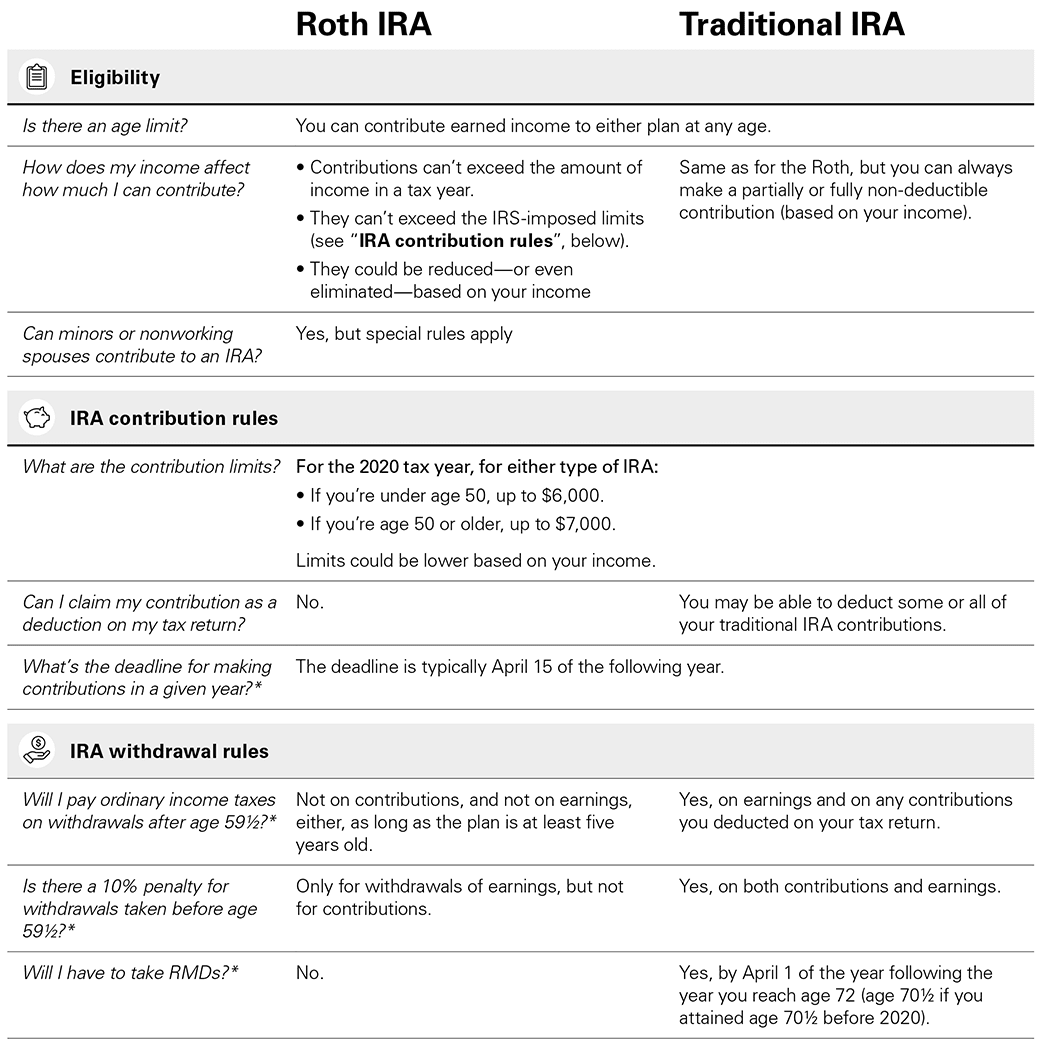

Roth vs. traditional IRAs: A comparison

*These provisions were significantly liberalized for traditional IRAs for tax year 2020 for taxpayers affected by the coronavirus pandemic. See your financial advisor for details.