Remember: Recoveries have rewarded patience

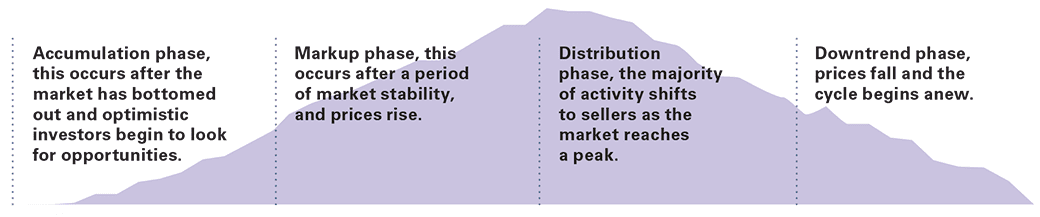

If you’ve ever taken an economics course, you might remember this basic principle: Economies and financial markets, such as the stock and bond markets, move in cycles. That is, you can count on markets to experience lows, when prices fall, and peaks, when prices surge. While no one has perfected the science of knowing exactly when those lows and highs will occur, you know the financial markets (and most global economies) will eventually come back around.

Four stages of a stock market cycle

Source: Vanguard.

This underscores the importance of maintaining a diversified, properly balanced portfolio (versus a highly concentrated, nondiversified one), which can more effectively withstand the shock of a market downturn. Perhaps more important, the inevitability of market cycles illustrates why reactive selling amid a downturn is harmful in the long run.

Taking the long view

When the financial markets are in turmoil and account balances start to fall, there can be a strong temptation to attempt to “do something” to stem any perceived losses. Yet it is often the case that staying the course—or doing nothing—proves to be the better path.

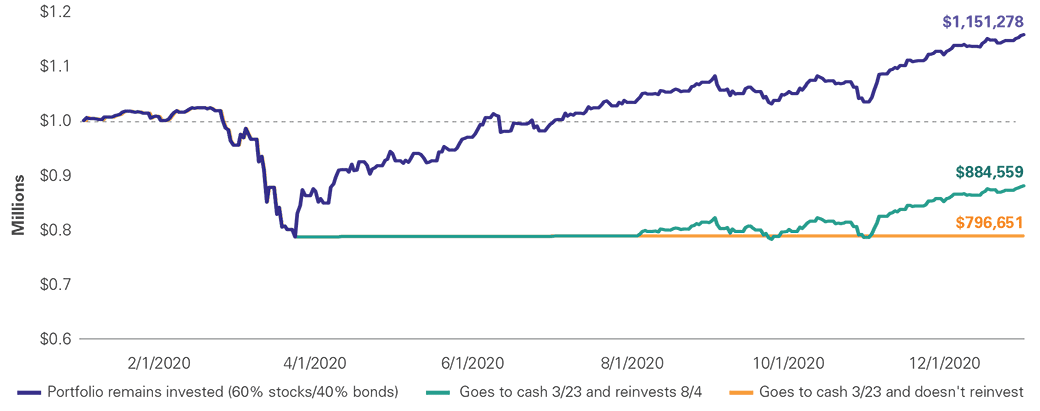

Here is one recent example: A hypothetical 60% stocks/40% bonds portfolio that stood at $1 million on January 1, 2020, would have lost about 20% of its value by March 23—when the stock market bottomed out from the coronavirus pandemic. Yet converting the portfolio to cash at that time would have cost an investor more than $350,000 over the next eight months versus the alternative of staying invested.

When faced with a similar situation, consider how you might feel if markets rebounded and you could have recouped all your money, and more. That’s why it’s best to stick to the long-term plan we have built together. Any changes should be made because of changes in your life, not changes in the markets. If you have questions about making portfolio moves, speak with us.

Staying the course can pay off; abandoning course can be costly

Returns for a hypothetical $1 million global portfolio consisting of 60% stocks/40% bonds

Sources: Vanguard calculations, based on data from FactSet, as of March 15, 2021.

Notes: U.S. stocks represented by CRSP US Total Market Index. U.S. bonds represented by Bloomberg Barclays U.S. Aggregate Float Adjusted Index. Global stocks represented by FTSE Global All Cap ex US Index. Global bonds represented by Bloomberg Barclays Global Aggregate ex-USD Float Adjusted RIC Capped Index. Cash represented by FTSE 3-Month U.S. Treasury Bill Index. Stock allocation consists of 60% U.S., 40% international. Bond allocation consists of 70% U.S., 30% international. Past performance is no guarantee of future results. The performance of an index is not an exact representation of any particular investment, as you cannot directly invest in an index.

Make successful investing easy—Make a plan

Just as you buy a health insurance plan to cover you and your family against sickness and injury, it’s smart to create a contingency plan for your portfolio for when the markets slide.

With a plan in place, it’s easier to tune out the noise that seems to amplify itself during times of financial stress (for instance, the one-size-fits-all advice of stock-picking gurus on financial news programs). Think of a plan as being like a suit of armor against impulsive decisions that could threaten your goals. A plan can be as simple as riding out any market downturns without making any changes. It might call for selling certain depreciated assets in order to rebalance your portfolio in a tax-advantaged manner. Or perhaps it involves adjusting your asset allocation at regular intervals, so you experience less volatility and less disruption to your income if you’re retired and drawing down your investment.

We can figure out together what type of proactive plan may work the best in your circumstances. Market downturns—or even just the thought of them—can cause concern. And they certainly can make an ugly dent in the portfolio you worked so hard to build. The good news is with patience and a little planning, you can breathe easier knowing that better market conditions will eventually reappear.